Michael Doherty, Director of Structured Solutions and Origination, Paratus

For years, energy procurement strategies could rely on a simple model: hedge forward, lock in price security, and minimise exposure to volatile spot markets. That approach no longer fits the realities of today’s energy landscape.

Market dynamics have fundamentally shifted. Price movements are now larger, more frequent, and harder to predict. The traditional belief that locking in a fixed forward price guarantees stability and competitive advantage is increasingly challenged by multi-year evidence – particularly when falling market prices mean the benefit of cover is forfeited. In addition, forward hedging carries an embedded premium, much like paying for insurance, which often results in a higher cost than simply taking market outcomes over time.

Bloomberg commodity fair value index

The problem with ‘set-and-forget’ hedging

Many corporate energy buyers are left with a binary choice:

- Fix all volumes

- Float all volumes

- Or attempt a static mix between the two

In practice, this leaves procurement teams with a narrow toolkit. It is easy to fall into the ‘habit’ of hedging mechanically on a year-by-year basis, constrained by what solutions are available from their suppliers or advisors. But when we examine the outcomes across the last 10 years, a pure forward-hedging strategy performs the worst of all approaches tested.

In our analysis, we compared four strategies over multiple years:

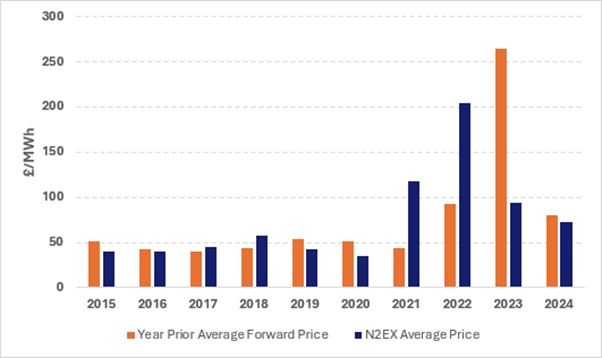

- Fixed: hedge everything at the average forward price (i.e., based on an average of how the market valued the ‘front year’ in the preceding year e.g. the daily value of 2015 during 2014)

- Float: expose everything to realised spot prices

- Flexible protection policy: activate coverage when market prices rise to a predetermined trigger, calibrated to the average forward cost, while paying a premium

The findings are striking:

- Pure forward hedging produced the highest cost outcome

- Pure floating had lower average costs, but with extreme volatility – a strategy few corporates would accept

- Hybrid policy – pre-set triggers with flexibility, meaningfully improved resilience and cost outcomes

Why?

- In 6 out of 10 years analysed, the realised price was lower than the forward price-hence it was a better strategy NOT to hedge in these years

- However, in some years e.g., 2021 the realised price was more than double what a buyer could have hedged it at the year before

- Before collapsing again, the next year to ~33% of the forward valuation

- Overall, there is no one size fits all strategy but being overly conservative can be value destructive in the long run

A New Hedging Paradigm: Flexibility Over Rigidity

The conclusion is clear –

A one-way, always-hedge procurement strategy is not fit for purpose in this volatile market.

Energy consumers need optionality, the ability to move between fixed and floating exposure as conditions change. This requires:

- Forward hedging frameworks enriched with market context

- Trigger-based risk overlays

- Tools that allow dynamic decision-making instead of static annual hedges

This is the direction sophisticated market participants are already moving. Our goal now is to broaden access to these insights and support procurement teams that are time-constrained and under-resourced, yet responsible for billions in energy spend.

The message to energy buyers is simple:

In volatile markets, flexibility isn’t optional, it’s a competitive necessity.

The results from our analysis of Bloomberg forward curves and N2EX baseload prices are clear: strategies that maintain some exposure to actual market prices consistently outperform rigid, single-track hedging policies. The market is simply too unpredictable for a one-way strategy to be fit for purpose.

Our analysis also shows that over a 10-year horizon, an insurance approach finishes approximately £10 per MWh better off – factoring in the full cost of the policy. This equals to £1 million per annum for a 100,000 MWh portfolio. In other words, flexibility doesn’t just reduce risk – it delivers value.

For those interested in exploring the modelling, assumptions, or results in more detail, our team would be pleased to walk through the analysis.

In today’s energy environment, flexibility is a measurable advantage.

This article appeared in the Nov/Dec 2025 issue of Energy Manager magazine. Subscribe here.